How To Use IMPORT EWB DATA Function In GSTR-1 - Full Explain

To import invoice-details, declared in e-Way Bill System, into Form GSTR-1; perform following steps:

1. Login at GST Portal, navigate to GSTR-1 page of the selected tax period and generate GSTR-1 Summary

2. Import invoices, declared in e-Way Bill System, into the following three tiles of the generated GSTR-1 Summary page:

I. 4A, 4B, 4C, 6B, 6C - B2B Invoices (To import invoice-details for taxable outward supply transactions between registered taxable entities/persons from e-Way Bill System)

II. 5A, 5B - B2C (Large) Invoices (To import invoice-details for taxable outward inter-State supply transactions between a Registered Supplier and an Unregistered Buyer, where the invoice value is more than Rs 2.5 lakh, from e-Way Bill System)

III. 12 - HSN-wise-summary of Outward Supplies (To download the summarized HSN-wise invoice-details of all outward supplies)

I. 4A, 4B, 4C, 6B, 6C - B2B Invoices

To import B2B EWB invoices in the Form GSTR-1, perform following steps:

1. Click the IMPORT EWB DATA button in the "4A, 4B, 4C, 6B, 6C - B2B Invoices" tile.

Note: EWB details will be available in GST portal based on the e-Way bills pertaining to outward supply raised during the relevant tax period.

2. Based on the number of invoices of current tax period present in the EWB System, a page will be displayed.

2a. If the number of invoices are less than or equal to 50

2b. If the number of invoices are more than 50 but less than or equal to 500

2c. If the number of invoices are more than 500

2a.If the number of B2B EWB invoices are less than or equal to 50

If the number of invoices are less than or equal to 50, following page gets displayed. Perform the steps as mentioned below or click the BACK button to go to the previous page.

2a(i). If required, click the DOWNLOAD button to download the invoices in CSV format or go to step 2a(ii) to import the data.

2a(ii). Select all the invoices by selecting the All selection box or select the selection boxes against the invoices to be imported. As you make your selection, the "IMPORT" button gets enabled. Click the IMPORT button.

2a(iii). An Information popup is displayed. Click the OK button.

2a(iv). A Success popup is displayed. Click the CLOSE button.

2a(v). After a few minutes, click the refresh button on the top and processing Status gets displayed in the "Import History" table.

Note: In case the invoices are processed with error, error report gets generated in JSON format, which can be viewed in the Offline tool to correct the same. Please click here. to view the step-by-step instructions on how to do this in the "Open Downloaded Error File – GSTR1" section of the Offline Tool Manual.

2a(vi). Click BACK and the imported B2B EWB invoice details would be reflected in the tile.

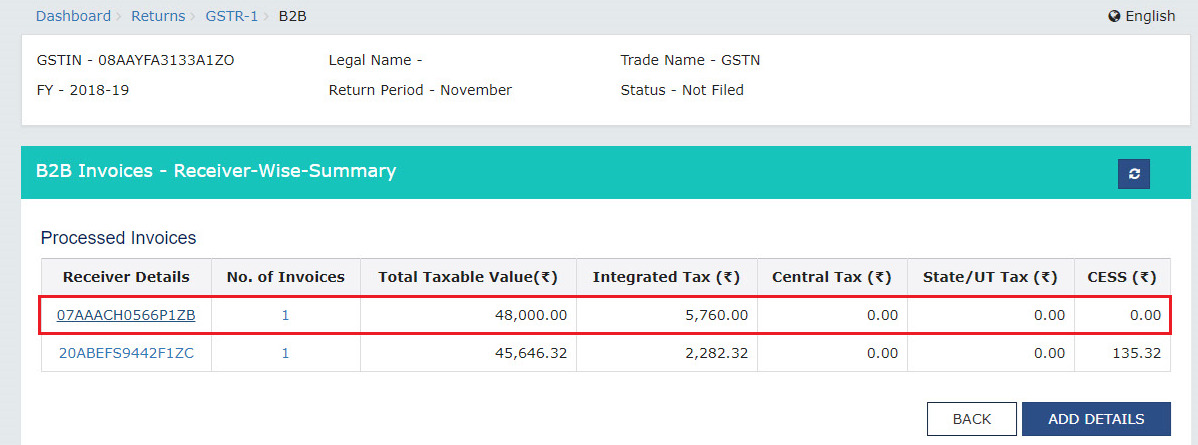

2a(vii). Click the tile to cross-check all the processed invoices. The imported B2B EWB invoice would be listed on the top of the "Processed Invoices" list.

2a(viii). To edit the imported B2B EWB processed invoice, click its hyperlink in the "Receiver Details" column.

2a(ix). The B2B Invoices-Summary page is displayed. Click the Edit button in the "Actions" column or the hyperlink in the "Invoice No." column to make changes to the invoice.

Note: Make sure you duly enter any supply detail. which was not covered in the e-Way Bill data, against the relevant tab separately in Form GSTR-1 before filing.

2b. If the number of B2B EWB invoices are more than 50 but less than or equal to 500

If the number of invoices are more than 50 but less than or equal to 500, following page gets displayed. Perform the steps as mentioned below or click the BACK button to go to the previous page.

2b(i). Click the DOWNLOAD button. A "b2b.csv" file gets downloaded as shown below.

2b(ii). To view the downloaded B2B EWB invoices, click on the downloaded b2b.csv sheet to open it. To upload these B2B EWB invoices using the offline utility,

Note: Make sure you duly enter any supply detail. which was not covered in the e-Way Bill data, against the relevant tab separately in Form GSTR-1 before filing.

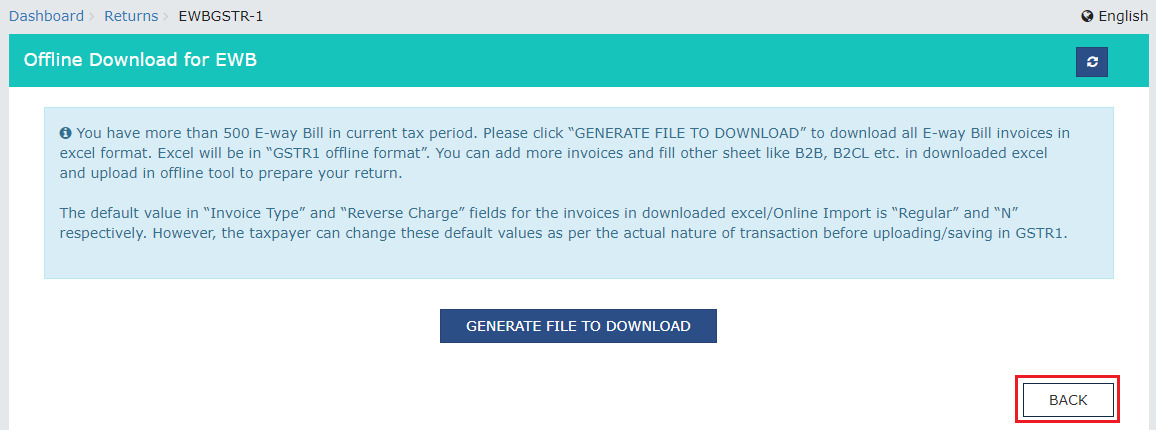

2c. If the number of B2B EWB invoices are more than 500

If the number of invoices are more than 500, following page gets displayed. Perform the steps as mentioned below or click the BACK button to go to the previous page.

2c(i). Click the GENERATE FILE TO DOWNLOAD button.

2c(ii). A message asking you to wait for 20 minutes gets displayed.

2c(iii). After 20 minutes, another message is displayed and a download link is also provided below the GENERATE FILE TO DOWNLOAD button. Click the link to download a zipped folder containing the B2B EWB invoices in excel format.

2c(iv). Right-click on the zipped folder and click Extract All.

2c(v) Unzipped Excel File gets displayed. Click it to open it.

2c(vi). The downloaded B2B EWB invoices get displayed. To upload these invoices using the offline utility, follow the steps mentioned here.

Note: Make sure you duly enter any supply detail which was not covered in the e-Way Bill data, against the relevant tab separately in Form GSTR-1 before filing.

Go back to the Main Menu

II. 5A, 5B - B2C (Large) Invoices

To import B2CL EWB invoices in Form GSTR-1, perform the following steps:

1. Click the IMPORT EWB DATA button in the "5A, 5B - B2C (Large) Invoices" tile.

Note: EWB details will be available in GST portal based on the e-Way bills pertaining to outward supply raised during the relevant tax period.

2. Based on the number of invoices of current tax period present in the EWB System, a page will be displayed.

2a. If the number of invoices are less than or equal to 50

2b. If the number of invoices are more than 50 but less than or equal to 500

2c. If the number of invoices are more than 500

2a. If the number of invoices are less than or equal to 50

If the number of invoices are less than or equal to 50, following page gets displayed. Perform the same steps you would have performed to import B2B invoices, as mentioned here.

Note: Make sure you duly enter any supply detail. which was not covered in the e-Way Bill data, against the relevant tab separately in Form GSTR-1 before filing.

Go back to the Main Menu

2b. If the number of B2CL EWB invoices are more than 50 but less than or equal to 500

If the number of invoices are more than 50 but less than or equal to 500, following page gets displayed. Perform the steps as mentioned below.

2b(i). Click the DOWNLOAD button. A "b2cl.csv" file gets downloaded as shown below.

2b(ii). To view the downloaded B2Cl EWB invoices, click on the downloaded b2cl.csv sheet to open it. To upload these B2CL EWB invoices using the offline utility,

Note: Make sure you duly enter any supply detail. which was not covered in the e-Way Bill data, against the relevant tab separately in Form GSTR-1 before filing.

Go back to the Main Menu

2c. If the number of B2CL EWB invoices are more than 500

If the number of B2CL EWB invoices are more than 500, following page gets displayed. Perform the same steps you would have performed to import B2B invoices, as mentioned here.

Note: Make sure you duly enter any supply detail which was not covered in the e-Way Bill data, against the relevant tab separately in Form GSTR-1 before filing.

III. 12 - HSN-wise-summary of Outward Supplies

To import HSN-wise EWB invoices in the Form GSTR-1, perform the following steps:

1. Click the IMPORT EWB DATA button in the "12 - HSN-wise-summary of outward supplies" tile.

Note: EWB details will be available in GST portal based on the e-Way bills pertaining to outward supply raised during the relevant tax period.

2. Based on the number of invoices of current tax period present in the EWB System, a page will be displayed. Click the following hyperlinks to know what happens in each case:

2a. If the number of invoices are less than or equal to 50

2b. If the number of invoices are more than 50 but less than or equal to 500

2c. If the number of invoices are more than 500

2a. If the number of HSN-wise EWB invoices are less than or equal to 50

If the number of HSN-wise EWB invoices are less than or equal to 50, following page gets displayed. Perform the steps as mentioned below or click the BACK button to go to the previous page.

2a(i). Click the DOWNLOAD button. An "hsn.csv" file gets downloaded as shown below.

2a(ii). To view the downloaded HSN-wise EWB invoices, click on the downloaded hsn.csv sheet to open it. To upload these invoices using the offline utility, please follow the steps mentioned here.

Note: Make sure you duly enter any supply detail. which was not covered in the e-Way Bill data, against the relevant tab separately in Form GSTR-1 before filing.

Go back to the Main Menu

2b. If the number of HSN-wise EWB invoices are more than 50 but less than or equal to 500

If the number of HSN-wise EWB invoices are more than 50 but less than or equal to 500, following page gets displayed.

Perform the steps as mentioned below.

2b(i). Click the DOWNLOAD button. An "hsn.csv" file gets downloaded as shown below.

2b(ii). To view the downloaded HSN-wise EWB invoices, click on the downloaded hsn.csv sheet to open it. To upload these invoices using the offline utility, please follow the steps mentioned here.

Note: Make sure you duly enter any supply detail. which was not covered in the e-Way Bill data, against the relevant tab separately in Form GSTR-1 before filing.

Go back to the Main Menu

2c. If the number of HSN-wise EWB invoices are more than 500

If the number of HSN-wise EWB invoices are more than 500, following page gets displayed. Perform the same steps you would have performed to import B2B invoices, as mentioned here.

Note: Make sure you duly enter any supply detail which was not covered in the e-Way Bill data, against the relevant tab separately in Form GSTR-1 before filing.

Thanks for sharing such a valuable information. Thanks a lot for sharing this helpful article with us.

ReplyDeleteportal Development

Travel portal development

Travel white label

Travel Portal Solution

B2C Travel Portal

B2B Travel Portal

Flight Booking API System

Flight api integration

thanks for sharing the information,

ReplyDeleteConsultaxx offers the best Income Tax servicesin Pune like Salary Income Tax Returns, Business Income Tax Returns, and Capital Gains Income Tax Returns.

Globals Indian

ReplyDeleteGlobals India

Global Indian

Global India

Globalindia

Global

Globals

Excellent blog with lot of information I really impressed with this blog click on

ReplyDeleteQuickbooks support Phone number California or dial on 800-901-6679 to know in more details

We are urgently in need of Organs Donors, Kidney donors,Female Eggs

ReplyDeleteKidney donors Amount: $600.000.00 Dollars

Female Eggs Amount: $500,000.00 Dollars

Email: jainhospitalcare@gmail.com

Whats App: +91 8754313748

Please share this post.

Very informative and wonderful blog post. Thanks for sharing. For online discount codes and coupons please visit Gearbest Discount Codes

ReplyDeleteReally awesome blog, your blog is really useful for me. Thanks for sharing this informative blog.

ReplyDeletetax return services in romford

We are urgently in need of Kidney donors with the sum of $500,000.00,Email: customercareunitplc@gmail.com

ReplyDeletethanks for the above updated info.

ReplyDeleteif anything regards synmac.in

GST-Consultants

incometax

company registration

GST Registration Consultants

GST training

GST return filing

plse check out the following links.

https://latestgstnews.blogspot.com/search?updated-max=2019-02-14T10%3A31%3A00-08%3A00&max-results=7#PageNo=6

ReplyDeleteVery nice blog on this website. It is really difficult to get this kind of useful information. I will eagerly look forward to your upcoming updates. Thanks for sharing it here.

ReplyDeleteGoods and Service Tax Network (GSTN)

WELCOME TO CONSUMER LOAN FIRM .......... Are you a businessman or a woman? Are you in any financial mess or do you need funds to start your own business? Do you need a loan to start a small-scale pleasant and medium business? Do you have a low credit score and are you finding it difficult to obtain equity loan from local banks and other financial institutes? Our loans are well insured for maximum security is our priority, Our main goal is to help you get the services you deserve, Our program is the fastest way to get what you need in a snap. Reduce your payments to ease the pressure on your monthly expenses. Gain flexibility with which you can use for any purpose - holiday, education, for exclusive purchases We offer a wide range of financial services, which includes: Business Planning, Commercial and Financial Development, Properties and Mortgages, Debt Consolidation Loans , Private Loans, Home Refinancing Loans with low interest rate at 2% per annul for individuals, companies. WE OFFER ALL TYPE OF LOANS, APPLY TODAY FOR AVAILABLE LOANS. Please contact us via email for more information: (consumerloanfirm@gmail.com)

ReplyDeleteGreat post !! Thanks for sharing valuable content.

ReplyDeleteClick here to know more Best apartments in Bangalore | Flat for sale in Bangalore- GR Group.

Am short of words for the amazing profit you helped me earn in just a week with binary options strategy am so sorry I doubted at the beginning, I invested $200 and earn $2,500 in just one week, and kept on investing more, today I am financially successful, you can contact him via email: carlose78910@gmail.com

ReplyDeleteVia whatsapp: (+12166263236)

I advice you shouldn't hesitate. He's great.

Your giving information is really awsome and keep update daily further details.If you required about GST consultants in delhi

ReplyDeleteGST Registration Consultants in delhi

new business registration delhi

tax return services delhi

Company registration in delhi

please click on it.

Thanks for this information and for this post.

ReplyDeleteGST filing online

Thank you for providing this article

ReplyDeleteGST Classes

very useful topic for everyone keep writting.. for looking any service regarding accounting management: Contact us account outsourcing services

ReplyDelete